Current income is helpful to reduce total college borrowing but is often limited because there are so many other needs for and demands on that money. True financial aid, i.e. grants and scholarships, offered as a result of financial need or merit, provides the best results because it does do not have to be repaid.

Families should carefully read the financial aid award letters colleges send to potential students because financial aid not only comes in the form of grants and scholarships, but also as student loans, which need to be paid back with interest. For most students, grant and scholarship money combined with current income do not fully meet the total cost of college, leaving families with a gap that almost always gets filled by family savings and college loans.

Saving for College is Better than Borrowing

When it comes to paying for college, “saving a dollar today is better than borrowing one tomorrow®.” Although student loans should be the last option to pay for college, saving in advance is the more attractive option. Even small amounts saved weekly or monthly add up, and compounding interest can work to significantly increase your savings with the benefit of time. By comparison, paying interest on a loan over time increases the total cost of the debt. Saving a dollar today for college really is better than borrowing one tomorrow!

Compare the Numbers

Saving $100 per month at a 4% rate of return compounded annually over 18 years produces an estimated savings of $30,773, including $21,600 in contributions and approximately $9,133 in earned interest.

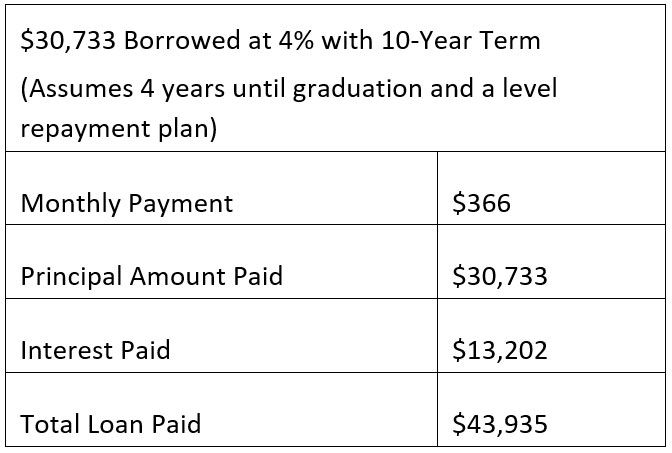

The following table provides a breakdown displaying the potential financial impact of borrowing $30,773 at 4% under a ten-year repayment plan, instead of saving in advance. The total out-of-pocket cost for the loan is approximately $43,935, more than twice the total contributions in the savings scenario. The cost of borrowing would be even greater if the repayment term was longer, or the interest rate was higher. And, while borrowers may be able to deduct part of their loan payments, borrowing is still the more expensive option.

Increase Savings/Reduce Borrowing

As you can see, minimizing borrowing by saving in advance makes financial sense. And for students, doing so can be important in freeing up income after graduation for other life goals such as saving for retirement or buying a new home.

Three Tips to Help Minimize Student Loans

- Save early and regularly.

Start saving and investing as early as you can to give yourself a longer time to meet your education funding goals. Save automatically through automatic transfers or payroll deductions to make it routine and easier to set aside money on a regular basis. You don’t need to save 100% of future costs. Just get started as soon as you can.

- Look for ways to increase your savings.

In years where you may have a bonus, a raise, or an income tax refund, for example, you may be able to put a little extra toward education costs. Minor life-style changes may help you find a bit extra per month to put toward college, such as eating out less frequently. Ask friends and family to participate as well.

- Take advantage of 529 plans.

529 plans offer many benefits, among them the tremendous benefit of tax-free growth. Earnings grow free from federal taxes and typically from state taxes as well when withdrawals are used for qualified expenses.

529 plan funds may be used nationwide for federally accredited apprenticeships, trade schools, community colleges, certificate programs, four-year colleges, graduate school and more.

Calculations in this article are for general educational purposes only and may not apply to your circumstances. Loan calculations assume interest accrues on the principal while student is in school plus a six-month grace period.